Today, international shipping generates around 3% of total global energy-related carbon emissions. Like many others, it’s an industry that has long relied on fossil-based fuels. However, growing pressure to decarbonize and meet the International Maritime Organization (IMO)’s emissions reduction targets – in line with the United Nations Paris Agreement’s 1.5 °C goal – is accelerating the transition to a new era of alternative fuels, including ammonia, biofuels, hydrogen, and electricity.

Between now and 2030, the International Energy Agency (IEA) claims that the maritime industry must reduce its carbon emissions by almost 15% if it’s to set itself on a trajectory consistent with the “Net Zero Emissions by 2050” scenario. Among the carbon reduction efforts maritime companies can take, scaling up the use of low- and zero-emission fuels will be key, as will the related technological innovation, government policies and industry-wide collaboration to drive adoption.

The good news is that major shipowners are already leading the way with new orders for alternative fuelled ships. According to Clarksons Research, around 44% of newbuild tonnage ordered in the first half of 2023 is set to be powered by alternative fuels, with liquefied natural gas (LNG) proving the most popular alternative, followed by methanol.

At the same time, amid uncertainties around the widespread availability of zero-emission fuels, shipowners are building and retrofitting their fleets to accommodate dual fuels, such as vessels that can run on diesel and methanol. They’re also developing ships that currently run on conventional fuels but, with a few modifications, will be able to accommodate alternative fuels such as ammonia in future – when technological readiness, ship designs, regulations and bunkering protocols catch up.

What are the main alternative fuels for ships?

Classification societies like the DNV recognize several alternative fuels that will help to drive the decarbonization of global shipping. They include:

- LNG: Gas is converted into LNG via a process called liquefication where it’s cooled to extremely low temperatures (around -162°C), transforming it from a gas to a liquid state. This reduces it to 1/600th of its original volume so it can be efficiently stored and shipped.

- Hydrogen: Like LNG, hydrogen must be cooled or compressed as it takes up a lot of space. Onboard fuel cells convert hydrogen into electricity and heat energy, which powers the ship’s propulsion mechanism.

- Ammonia: A compound of nitrogen and hydrogen, ammonia becomes liquid at -33°C, which means it doesn’t need to be stored in high-pressure or cryogenic tanks.

- Methanol: This biodegradable alcohol is liquid at ambient temperatures so it can be transported, stored, and bunkered using similar standard safety procedures to diesel.

All these alternative fuels exist in two forms: the conventional form and the eco-friendly version, which is why they’re referred to as grey, blue or green methanol and hydrogen and so on. Green hydrogen and other green fuels are the most environmentally sustainable forms of fuel as they’re produced solely using renewable energy sources such as solar or wind. Meanwhile, blue forms of fuel capture and store the carbon generated from production.

The biggest challenge currently is that most alternative fuels produced today are grey or brown, which means they’re made using fossil fuels such as coal or natural gas and emit carbon emissions in the production process. If you consider the full well-to-tank calculation (how the fuel is produced and used) of grey or brown alternative fuels, in some cases, the overall carbon impact makes them more polluting than diesel.

What is the most promising alternative fuel for ships?

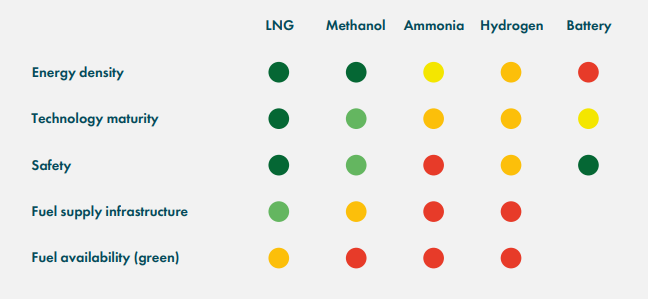

As emission limitations tighten, shipbuilders want clarity on which fuels to bet on for the future. While there is no crystal ball for this, reports tend to suggest that ammonia holds the greatest long-term potential, despite there being no commercial ships running on ammonia today.

According to the IEA, ammonia has already been proven in tests by engine manufacturers and industry leaders will roll out the technology within the next couple of years. At the end of 2022, it said that around 150 ammonia-ready vessels were on order, representing roughly 15% of the total market share.

Given the evolving nature of technologies and the regulatory environment, it’s likely that we’ll see a variety of alternative fuels gaining traction across the industry. Certainly, in the short to medium term, we can be confident that LNG will continue to dominate the fuel mix, followed by ammonia and methanol and, perhaps in the future, hydrogen.

Overcoming challenges for the adoption of alternative fuels

The main reason for the transition to alternative fuels is, of course, that they’re more sustainable and will help in the wider effort towards building a net-zero future. Today, general calculations show that LNG already reduces overall greenhouse gas emissions by up to almost a quarter compared to heavy fuel oil.

Transitioning to alternative fuels also opens up opportunities to optimize fleets’ operational performance and save further costs. However, challenges remain in the way of widespread adoption, namely:

Cost: Alternative fuels are currently significantly more expensive to buy than fossil fuels – in some instances they’re double the cost. Industry stakeholders will also need to factor in costs for new ship technologies and designs, as well as all related infrastructure, including land-based storage and bunkering. The Getting to Zero Coalition estimates that between 2030 and 2050, the industry will need to invest approximately US$0.8-1.2 trillion to achieve the IMO’s carbon reduction targets.

Market uncertainty: Shipping’s path to a more sustainable future remains uncertain, and without clear policies and regulations, key industry stakeholders are unsure where to focus their investments when it comes to alternative fuels and their associated infrastructure, retrofitting ships and scaling up R&D activities.

Availability: By 2030, if shipping is to succeed in achieving its emission reduction goals, it’s expected to consume around 30% to 40% of the total world’s supply of carbon-neutral fuels. Understandably, shipbuilders are concerned whether demand can keep up with supply, especially as they find themselves competing against other industries for the same fuels. Many ask whether it will be possible to deploy sufficient renewable energy infrastructures such as renewable power and e-fuel production plants.

In the meantime, so-called drop-in fuels will play an important role as they can be used directly inside existing engines with some positive carbon reduction effects. For example, renewable synthetic LNG (made of renewable hydrogen and carbon dioxide capture) or BioLNG (made from organic waste) are chemically identical to fossil LNG but carbon-neutral and have made significant advances in recent months.

Designing ships for a sustainable future

For the marine industry to successfully meet IMO’s zero-emissions carbon goal, it must fully transition to a 100% renewable energy mix by 2050. Over the next decade, shipbuilders will need to come up with innovative new vessel designs to accommodate alternative fuels, considering how to integrate larger onboard tanks and how to retrofit or prepare engines to accept new fuels.

Considering that the typical lifecycle of a large vessel is up to 30 years – or more – it’ll be up to shipowners to future proof their investments and position themselves to become fuel agnostic, where a ship and its associated propulsion will be able to accommodate multiple types of fuel. To do this, they’ll need to plan for multiple scenarios and usages right from the concept design stage, and adopt modern product development technologies and methodologies, such as model-based systems engineering (MBSE).

Initiatives such as the NAVAIS project prove the potential of an MBSE, platform-based approach for developing, standardized, modular ships that take into account all requirements from the beginning, including sustainability. Through these types of innovations, the industry can respond with agility to market demands, while reducing costs and improving its environmental performance. And this is just the beginning of what’s to come. There are now more than 370 pilot and demonstration projects focused on zero-emission vessel technologies underway.

Read more articles

Green corridors: from concept to reality