By Cameron Collie, DELMIA Worldwide Industry Expert – Rail, Dassault Systèmes

From evolution, decline, and to resurgence, rail transport has undergone distinct phases that have shaped its progress. Understanding this historical context is crucial as we explore the current state of rail renaissance and the immense opportunities it presents.

A brief history of modern rail

- Rail 1.0 – The era spanning from the 1750s to the 1900s witnessed the emergence of regional rail systems driven by private investments and endeavors.

- Rail 2.0 – The period between 1900 and 1950 was marked by two world wars, during which rail assets underwent a transition into public ownership and rail systems were seen as strategic assets.

- Rail 3.0 – From 1950 to 2010 the rise of private automobile ownership and the emergence of aviation as a popular long-distance travel option led to a decrease in rail usage and insufficient funding for rail infrastructure.

- Rail 4.0 – Since around 2010, the world has witnessed a renaissance of rail and a significant increase in rail investments, largely driven by sustainability factors.

Rail industry outlook

In 2018, Frost and Sullivan, in conjunction with the International Union of Railways (UIC), had predicted that by 2025, investments in rail transport will surpass those in other modes of transportation.

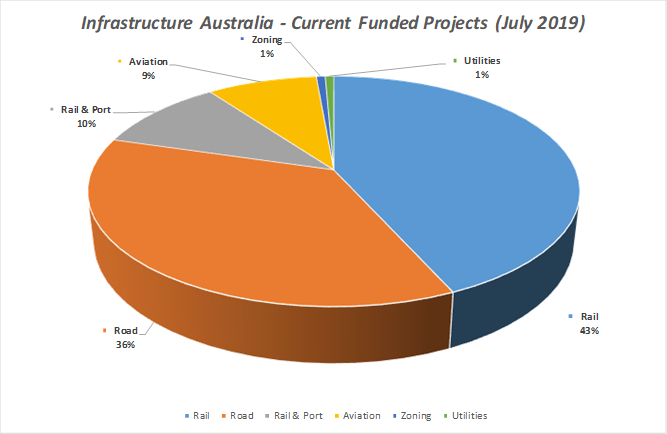

However, Australia has already achieved this milestone, as revealed in 2019 when Infrastructure Australia reported that rail projects accounted for 43% of all currently funded projects, surpassing investment in any other sector. With an additional 10% dedicated to rail and port projects, rail investments in Australia constitute almost 50% of the total infrastructure investments by the federal government.

Global impacts

The surge in rail investments is not limited to Australia alone; it is a global phenomenon with far-reaching implications:

- Australia and New Zealand -. Rail investments have exceeded those of other transport modes for the first time since 2018.

- Asia-Pacific (excluding China) – New rail projects in this region currently exceed USD 1 trillion, totalling over 79,000 kilometers of new railway.

- North America – The United States, under the Federal Infrastructure Bill, has allocated USD 80 billion solely to a government-owned long-haul passenger operator, for the purpose of upgrading the country’s infrastructure assets and systems.

- Latin America – The region is witnessing a surge in interest, with over 40 applications for rail operator licenses currently in progress.

- Europe – The European Commission has set a mandate requiring a 30% modal shift from road to rail by 2030 and 50% by 2050.

Opportunities in rail

Amidst the global rail renaissance, the industry is presented with significant opportunities for growth.

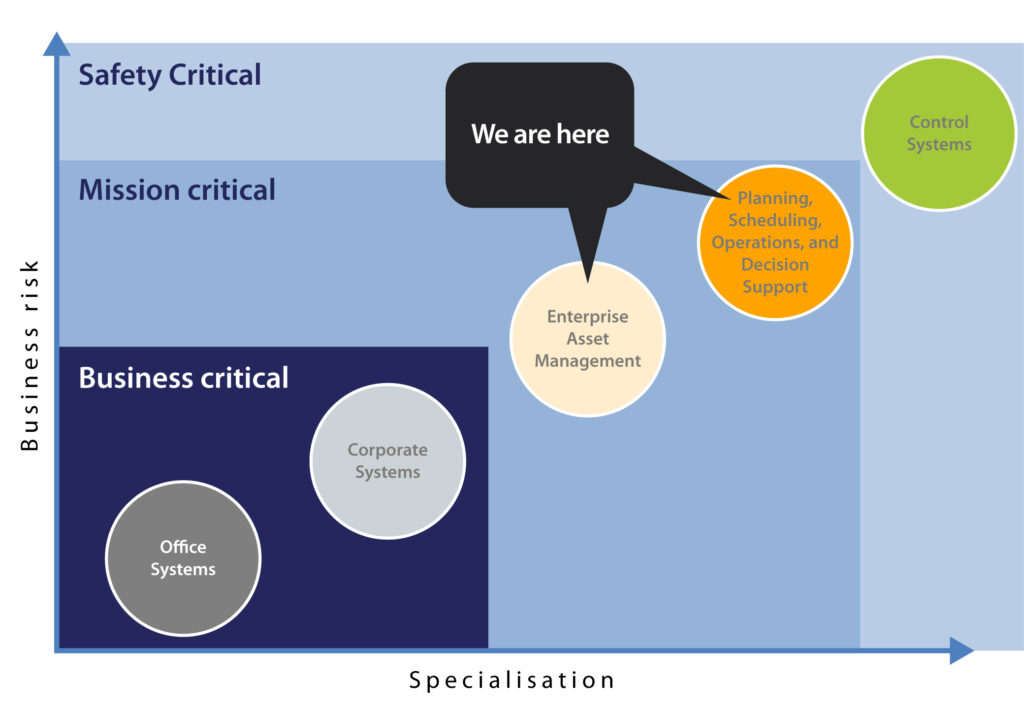

Dassault Systèmes’ designated area of focus in the sector provides valuable insights into these opportunities.

This specialization is crucial for capitalizing on rail opportunities as it drives both the global renaissance and increased investment, including investments in rail systems.

After rail’s post-world war decline, major IT vendors focused on developing business-critical office systems and Enterprise Asset Management systems for maintenance, planning, and execution. However, they showed minimal interest in the core operations of running a railway, such as planning, scheduling operations, service planning, capacity planning, and crewing the fleet. Consequently, rail companies had to either develop their own solutions or adapt systems from emerging industries, with aviation being a common example.

Typically, solutions adopted from other industries require extensive customization to suit the unique needs of rail. As a result, rail companies face the challenges of rapid growth and increasing demand while operating on outdated technology foundations.

The existing systems are outdated, difficult to maintain, and ill-suited for their specific requirements, posing a considerable business risk.

The opportunities in the rail industry are twofold:

- There is a significant pent-up demand for integrated technology solutions resulting from the utilization of aging legacy systems or heavily customized solutions.

- Sustainability-focused technology solutions are experiencing demand growth in this era of Rail 4.0 and net zero emission targets.

According to recent market analysis conducted by specialists at Dassault Systèmes, the CAGR for rail growth has now surpassed 6% to 8% per annum in certain cases as opposed to the usual 3% until recently. This substantial increase of over 100% in growth validates the occurrence of the rail renaissance and highlights the heightened level of investment being made in the industry.

The opportunity to digitally transform rail operations with sustainability at the core using integrated rail solutions has never been as pronounced as it is today. With such solutions global rail operators can set practical targets to achieve net zero emissions by 2050 or earlier.