In Italy, construction is underway on the first hydrogen-powered cruise ship, setting a new benchmark for the maritime industry’s decarbonization efforts. In Finland, naval architects design icebreakers capable of handling the shifting, unpredictable ice conditions of the Baltic Sea. And off the coast of the Netherlands, zero-emission workboats roll out of the shipyard, ready to ferry technicians to the offshore wind farms that power Europe’s clean energy future.

These projects all capture the unique strengths of Europe’s shipyards, which are renowned for their global leadership in complexity and innovation. From luxury cruise ships and naval frigates to advanced workboats and vessels powered by alternative fuels, Europe carves out a decisive share in the global industry as a region defined by specialization.

What is the current state of the shipbuilding industry in Europe?

Europe’s shipbuilding sector may represent a smaller slice of the global market compared to other parts of the world — just 6% of the global commercial orderbook — however, that figure only tells part of the story. Across the continent, shipyards are delivering some of the world’s most advanced and sustainable vessels. The region’s orderbook grew from 9.6 million GT (302 ships) to 11 million GT (324 ships) in 2024, driven by growing demand for cruise liners and dry cargo ships – the latter seeing a boost thanks to shorter delivery times. Within all of this, Europe’s largest yards focus on very big, technically demanding projects, while a wide network of smaller shipyards excels in specialized, high-value vessels that few other regions can match.

The EU’s Industrial Maritime Strategy reflects this reality and aims to strengthen the sector’s resilience while promoting innovation and accelerating decarbonization. Supported by strong maritime clusters across Europe, shipbuilders, suppliers and governments are collaborating to push the agenda on green technologies and digital transformation.

Which countries are leaders in European shipbuilding?

Europe is home to several centers of expertise, making the continent a leader in some of the most complex and strategically important segments of the maritime industry. Consider cruise liners: nearly every major vessel launched in the past decade has come out of European shipyards. Among the global leaders, Fincantieri and Meyer Werft are setting the standard for the next generation of sustainable, high-tech ships. The same is true in naval shipbuilding. Eight European companies sit in the global top 25, including BAE Systems in the UK, Naval Group in France and TKMS in Germany. These firms are behind some of the most advanced frigates, submarines and patrol vessels in the world. And then there are the niches where Europe dominates. Finland is responsible for designing 80% of the world’s icebreakers and constructing 60% of the global fleet. Poland and Romania lead in laying the subsea cables that connect offshore wind farms to the grid. And Damen, in the Netherlands, builds the workboats that make Europe’s clean energy transition possible.

Which types of ships are built in Europe?

Europe’s reputation rests on its ability to build the most complex ships afloat. These include:

- Cruise liners: nearly all of the world’s largest cruise ships are built in Europe

- Offshore wind service vessels: specialized workboats that support Europe’s green energy agenda

- Icebreakers: Finland is recognized as the global leader in this segment

- Ferries, tankers and niche builds: smaller in scale yet highly technical.

Naval revival and defense opportunities

Defense is another area where Europe’s shipbuilding expertise shines. Within the world’s top 25 naval shipbuilders, eight are European, accounting for a quarter of the global market. Industry leaders like BAE Systems, Naval Group, Babcock, Fincantieri, TKMS, Navantia, Damen and Saab Kockums are at the forefront of delivering next-generation frigates, patrol vessels and submarines. Rising defense budgets across the continent continue to drive new opportunities. In 2014, only two European NATO members spent 2% of gross domestic product (GDP) on defense. Today, 16 out of 23 do as they up their investment in equipment and procurement. Programs like the European Patrol Corvette, a joint initiative involving France, Greece, Italy and Spain, highlight a growing trend towards collaboration and long-term naval fleet renewal. Meanwhile, the EU’s ReArm program could mobilize up to €800 billion for defense, unlocking opportunities for naval shipyards to scale their capabilities and strengthen Europe’s strategic autonomy at sea.

How can digital transformation benefit European shipbuilding?

Modern shipbuilding is a highly complex engineering challenge. Managing this kind of scale with legacy software is almost impossible, which is why digital transformation plays a critical role in making all this complexity manageable.

Dassault Systèmes’ 3DEXPERIENCE platform gives shipbuilders a shared digital environment to design, engineer, model, simulate and collaborate across the product development cycle from concept to delivery and beyond. By replacing fragmented processes and systems with a unified platform, shipyards can tackle complexity head on and bring new ships to market faster, more cost effectively and with fewer errors.

Key capabilities include:

Collaboration: A centralized digital environment connects all data and stakeholders, breaking down silos and keeping projects on track while reducing costly mistakes.

Model-based systems engineering (MBSE): Create a true system of systems model that makes sure every subsystem decision connects to the overall design and integrates seamlessly.

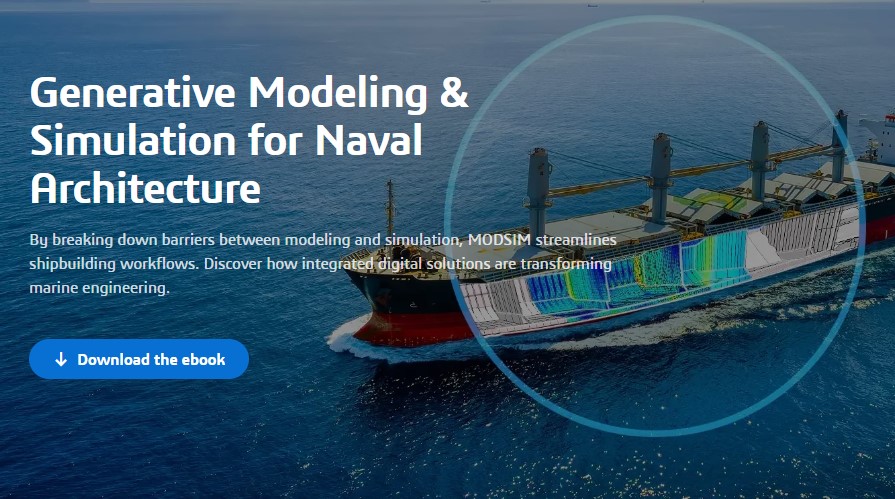

Modeling and simulation (MODSIM): Teams design, test, and refine propulsion systems, fuel options and structural variations in parallel, dramatically accelerating development and finalizing design decisions long before steel is cut.

Virtual twin: A high-fidelity virtual replica captures the full lifecycle, behavior and evolution of a vessel. By running simulations, teams can optimize design, materials and processes with full traceability. As operational data and maintenance records feed back in, the virtual twin evolves, delivering predictive insights that drive continuous performance improvements.

Key European shipbuilders like Damen Shipyards and Naval Group rely on the 3DEXPERIENCE platform to transform their approach to shipbuilding.

Today, the 3DEXPERIENCE platform supports them to handle complex vessel configurations, track all design changes and modifications, and collaborate effectively across the value chain. By adopting Dassault Systèmes Marine solutions, Damen managed to eliminate manual spreadsheet workflows and moved to a configure-to-order approach so it could rapidly tailor vessels to customer needs.

How can European shipyards remain competitive globally?

Global competition in shipbuilding is fierce, yet Europe’s edge lies in its ability to deliver the kinds of complex, high-value vessels that others can’t. Smaller scale doesn’t mean smaller impact. If anything, Europe is emerging as the world’s innovation center for the future of shipbuilding, proving it can meet the demands of both the clean energy transition and widespread defense renewal programs.

Combine rising defense budgets, soaring demand for sustainable vessels and the world’s eye on the region’s expertise, and the stage is set for a renaissance in European shipbuilding.

The question now is less about potential and more about execution: how quickly can Europe’s shipyards scale up, embrace the latest digital capabilities and seize this opportunity?

Discover more

The Rise of Automation in Shipbuilding: Transforming the Industry with Robotics

Could nuclear energy decarbonize cargo shipping?

Charting the path to greener shipping with onboard carbon capture