The heavy mobile machinery manufacturing industry, long powered by diesel engines, is undergoing a significant transformation. Electrification is no longer a concept limited to passenger vehicles; it is rapidly becoming a viable and compelling alternative for construction, mining, and agricultural equipment. This shift is driven by a convergence of technological innovation, regulatory pressures, and evolving economic models. As the industry moves toward a more sustainable future, understanding the dynamics of electrification is essential for engineering leaders.

This article explores key trends, challenges, and opportunities associated with the electrification of heavy mobile machinery. It examines the environmental and economic drivers, the state of current technology, and the pioneers paving the way. Finally, it looks ahead to how this electric revolution could fundamentally reshape the industry’s design and production processes.

The Driving Forces Behind Electrification

The transition to electric power in heavy mobile machinery is not a singular trend but the result of multiple interconnected factors. These drivers range from global environmental goals to practical operational advantages.

- Environmental and Regulatory Pressures

A primary catalyst for electrification is the global push to reduce greenhouse gas emissions and combat climate change. Heavy mobile machinery is a significant contributor to carbon dioxide (CO2) and nitrogen oxide (NOx) emissions, as well as particulate matter. Governments worldwide are implementing stricter emissions standards for non-road mobile machinery (NRMM).

In urban areas, regulations are becoming even more stringent. Cities like Oslo, Copenhagen, and Amsterdam are establishing zero-emission zones, effectively mandating the use of electric or other non-fossil fuel equipment for construction projects. This regulatory landscape creates a strong incentive for investment in electric alternatives to ensure market access and compliance.

- Economic and Operational Benefits

While the initial purchase price of electric heavy mobile machinery can be higher than that of diesel models, the total cost of ownership (TCO) often presents a compelling business case. Electric machines have fewer moving parts, no internal combustion engine, and require no oil changes or complex exhaust after-treatment systems. This results in significantly lower maintenance costs and reduced downtime, improving operational efficiency.

Fuel costs are another major factor. Electricity is generally cheaper and has more stable pricing than diesel fuel. As battery technology improves and energy density increases, electric machines can operate for a full workday on a single charge, making them operationally competitive. Furthermore, the quieter operation of electric machinery reduces noise pollution, allowing for extended operating hours in noise-sensitive areas and improving worksite communication and safety.

Key Challenges on the Path to Adoption

Despite the clear benefits, the widespread adoption of electric heavy mobile machinery faces several significant hurdles that must be overcome through strategic engineering and investment.

- Battery Technology and Charging Infrastructure

The core challenge lies in battery technology. Heavy mobile machinery requires immense power and energy density to perform demanding tasks like digging, lifting, and hauling. Current battery packs are often large, heavy, and expensive, which can compromise machine design and performance. While battery technology is advancing rapidly, achieving the energy density of diesel remains a long-term goal.

The lack of standardized and readily available charging infrastructure at remote construction and mining sites is another major barrier. Unlike passenger cars, heavy machines cannot simply pull up to a public charging station. Deploying high-capacity, fast-charging solutions on temporary or rugged job sites requires substantial planning and investment. Mobile charging units and battery-swapping systems are emerging as potential solutions, but they are not yet widely available.

- High Initial Investment and Performance Concerns

The upfront cost of electric heavy equipment is a significant deterrent, particularly for small and medium-sized enterprises. The high price of battery packs accounts for a substantial portion of the vehicle’s total cost. Although TCO analysis may favor electric options in the long run, the initial capital outlay can be prohibitive.

Concerns also exist about the performance and durability of electric machines in harsh environments. Questions about machine reliability in extreme temperatures, the lifecycle of batteries under heavy-duty cycles, and the ability to match the raw power of diesel engines must be addressed through rigorous testing and real-world performance data.

Technological Advancements and Opportunities

Innovation is rapidly closing the gap between diesel and electric performance. The industry is responding to the challenges with creative engineering and new business models.

- Innovations in Battery and Powertrain Systems

Manufacturers are developing more efficient electric motors, advanced thermal management systems, and modular battery packs. Solid-state batteries, though still in development, promise a future with higher energy density, faster charging, and improved safety. For larger equipment, hybrid systems that combine a smaller diesel engine with an electric powertrain offer a transitional solution, reducing emissions and fuel consumption without sacrificing performance.

Another key opportunity is energy recuperation. Technologies like regenerative braking, common in electric cars, can be adapted for heavy machinery. For example, an excavator can capture energy when lowering its boom and use it to recharge the battery, improving overall efficiency and extending operating time.

- Industry Pioneers Leading the Charge

Several established manufacturers and innovative startups are at the forefront of the electrification movement.

- Volvo Construction Equipment has committed to moving its compact wheel loader and compact excavator ranges to electric. The company has already brought models like the L25 Electric wheel loader and ECR25 Electric excavator to market, demonstrating the viability of electric power in smaller equipment.

- Caterpillar is developing a range of battery-electric products and has demonstrated an all-electric 793 mining truck. The company is focused on a holistic approach that includes on-site charging solutions to create a complete electric ecosystem for mine sites.

- JCB has introduced a variety of electric machines, including the 19C-1E, the industry’s first fully electric mini excavator. They have also developed a universal fast-charging solution designed for construction and agricultural machinery.

- Komatsu showcased a fully electric remote-controlled mini excavator and is actively working on electrifying its larger equipment, aiming to reduce its product carbon footprint significantly.

These examples show a clear commitment from industry leaders to invest in and commercialize electric technologies, signaling a definitive shift in the market’s direction.

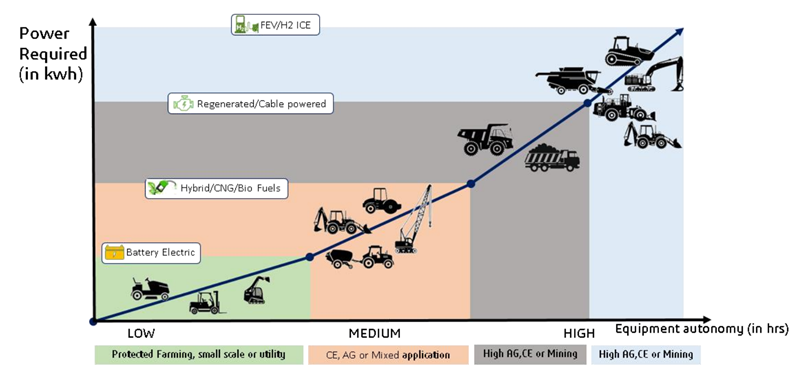

- Electrification Solutions by Power and Autonomy

For applications with low power needs and short autonomy (such as protected farming, small-scale, or utility work), battery electric solutions are prevalent. These machines operate effectively within limited energy demands while supporting sustainability targets for smaller operations.

For medium-powered machinery with moderate autonomy needs (typical of mixed construction equipment, agriculture, or hybrid uses), technologies such as hybrid systems, CNG, and biofuels bridge the gap between pure battery electric and traditional combustion engines. These solutions balance longer run times with reduced emissions, making them well-suited for general earthmoving, mid-sized tractors, and cranes working over variable durations.

As both power requirements and operational autonomy increase—characteristic of large-scale mining, heavy construction, and intensive agriculture—the market favors regenerated/cable-powered machines and fuel cell/ICE (FCEV/H2 ICE) technologies. These solutions enable continuous, high-output operation across extended shifts, overcoming the practical limits of battery storage in high-demand environments.

Strategic Trends

In summary, the path toward electrification in heavy mobile machinery is not uniform—it depends on matching the technology to the specific power and autonomy profiles demanded by each segment. This segmentation will drive innovation and adoption across the industry in the coming years.

- Battery electrics are ideal for urban, confined areas and short-cycle utility roles, where zero emissions and low noise are priorities.

- Hybrid and alternative fuels extend machinery capability for mid-range applications, providing operational flexibility during transitions away from fossil fuels.

- Cable power, regenerated energy, and hydrogen fuel cells unlock true autonomy for energy-intensive, remote or high-output machinery, essential for mining or major infrastructure projects.

The Future of Heavy Mobile Machinery Manufacturing

Electrification is set to fundamentally reshape the heavy mobile machinery industry. As technology matures and costs decrease, electric machines will move from niche applications to mainstream use. This transition will not only be about swapping a diesel engine for a battery and motor; it will enable entirely new ways of working.

The integration of electric powertrains with automation and telematics will create smarter, more efficient, and safer job sites. Autonomous electric haul trucks in mines can operate 24/7, charged by renewable energy sources, supporting a fully decarbonized and optimized operation. In cities, quiet and emission-free construction sites will become the norm, improving urban living conditions.

The road ahead requires continued investment in research and development, collaboration between manufacturers and energy providers, and supportive government policies. While diesel will likely remain relevant for certain heavy-duty, remote applications for some time, the trajectory is clear. The electric era of heavy machinery has begun, promising a cleaner, quieter, and more efficient future for the industries that build our world.

The future of heavy machinery is electric and sustainable. Engineer the equipment that will build a cleaner world with our comprehensive solutions.

Discover more here