From personalizing services to optimizing processes and enhancing security, generative AI is radically changing the banking ecosystem. Let’s take a closer look at the technology which is redefining practices in the financial sector and generating new models for value creation.

The banking sector is undergoing a profound technological change. According to IDC figures, in 2024 banks invested more than €150 billion in artificial intelligence, accounting for 13% of global AI investment. This adoption of AI reflects a strategic development: artificial intelligence, and more specifically generative AI, is becoming a key tool for staying competitive in a constantly-changing financial landscape.

From Traditional AI to Generative AI: A Multidimensional Transformation

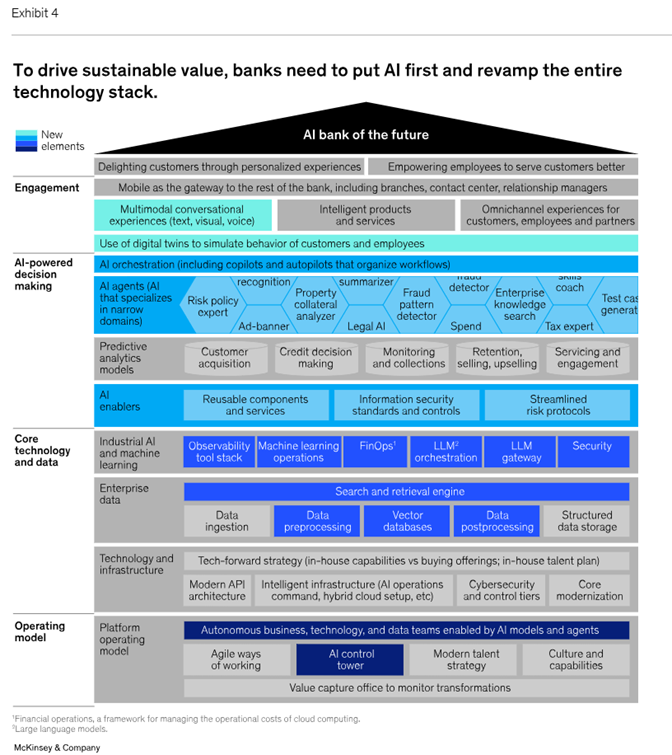

The use of artificial intelligence in banking has evolved in successive stages, with the emergence of generative AI being the latest (and most spectacular!) development. This evolution is centered around two types of AI, each of which offers distinct applications. Traditional AI and machine learning are the historical foundation which has driven automation in the banking sector. For years, these technologies have driven fraud detection, credit risk assessment, and predictive analytics by recognizing patterns in historical data. Their effectiveness is documented: case studies show that major banks such as Danske Bank have achieved significant savings by using AI to combat fraud, and that other institutions have seen significant reductions in fraudulent transactions. Generative AI and large language models (LLMs) represent a new generation of artificial intelligence that can generate text, summarize data, answer complex questions, and automate communications. This technology is radically transforming customer service, compliance processes, and internal operations. An analysis by McKinsey & Company predicts that the implementation of generative AI in the European banking sector will increase by 30% each year until 2026, with a 45% increase in use in direct customer service.

When Generative AI Revolutionizes Value Creation in Banking

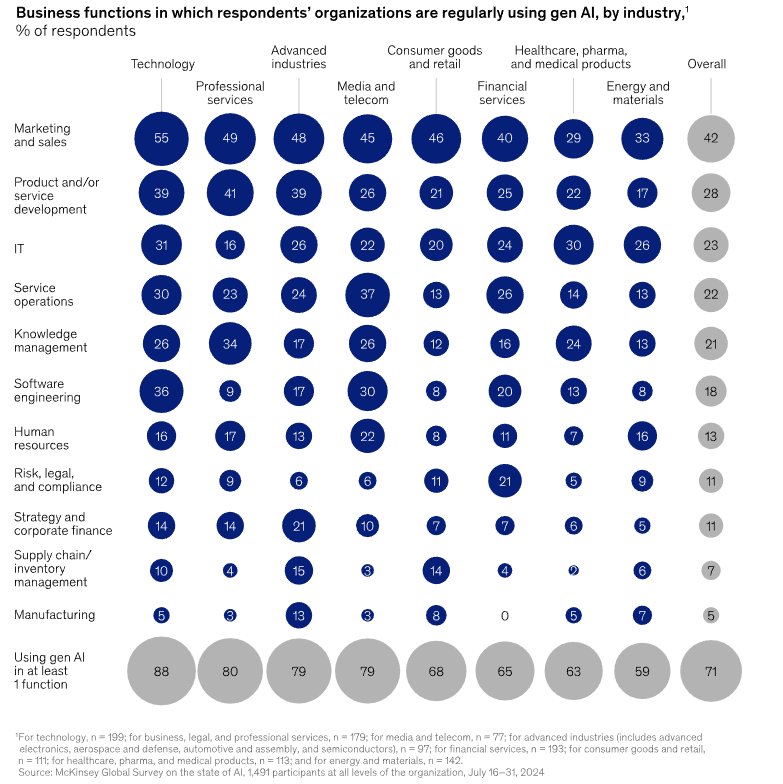

The impact of generative AI extends far beyond gains in operational efficiency: it goes right to the heart of corporate strategy. Organizations that successfully implement AI transformation strategies have some fairly important traits in common. AI governance led by senior management (CEO, COO) is the number one success factor. Organizations in which AI initiatives are overseen by senior management often report a significantly greater financial impact. This strategic involvement ensures the allocation of the necessary resources and the necessary organizational alignment. The widespread adoption of generative AI is also changing the skills required at every level of organizations. The financial sector is characterized by its particularly intensive use of generative AI in risk, legal, and compliance departments, with an adoption rate which is twice that of other industries.

This sector-specific adoption of AI is a reflection of these departments activities: the massive processing of regulatory documents, the analysis of complex contracts, and managing compliance all require understanding and synthesis capabilities that generative AI masters particularly well. Measurable financial impacts confirm the transformative potential of this technology. A recent survey by Xerfi indicates that operators in the financial sector are projecting an annual increase in revenue of 3 to 5% starting in 2025 through the use of this technology. The returns on investment observed reveal significant gains thanks to the hyper-personalization of customer communications and substantial reductions in operating costs through intelligent automation.

Generative AI and the Banking Sector: Concrete Applications

Generative AI is revolutionizing the entire banking value chain, from customer communications to back-office operations and risk management. Next-generation customer communications are the most visible change. Once limited to preset responses, chatbots are turning into conversational agents that can provide dynamic and personalized interactions. Now, these virtual assistants allow customers to access personalized financial advice in real time and to carry out complex transactions via intuitive interfaces. One survey conducted by Capgemini in 2024 reveals that financial institutions using these tools have seen a 20% increase in user approval and a 15% decrease in operating expenses linked to technical support. Compliance and risk management particularly benefit from the capabilities of generative AI. Automating document review, Anti-Money Laundering (AML) and Know Your Customer (KYC) processes, as well as entity risk profiling significantly accelerates processing times while reducing compliance costs. Automatic regulatory reporting and real-time monitoring of transactions transform compliance from a cost center into a competitive advantage.

In practice, generative AI’s impact on operational optimization extends to all banking processes. LLMs automate KYC procedures, customer onboarding, loan processing, and the routing of support requests. This automation frees teams from repetitive tasks so that they can focus on higher value-added activities.

The rise of copilots reflects this hybrid approach, where humans and machines work together, combining their strengths to constantly generate greater value…and values! Internally, analyst assistants, development copilots, and fraud detection agents augment human capacities. Externally, personalized financial concierges offer an enhanced customer experience, available 24 hours a day.

OUTSCALE and Mistral AI: A Sovereign Generative AI Solution Designed for Banks

To meet the challenges of digital sovereignty and regulatory compliance, Dassault Systèmes and Mistral AI have developed a joint approach: a secure and sovereign solution called Large Language Models as a Service (LLMaaS) that enables banks to adopt generative AI while retaining control over their data and intellectual property. This solution’s potential is best demonstrated by concrete examples of its applications. Financial analysts today spend a considerable amount of time manually collecting and analyzing data from multiple sources. This traditional approach limits their productivity and delays decision-making. However, if our AI solution is implemented, this operational reality changes. The AI assistant can understand natural language queries, retrieve relevant financial data, and generate graphics automatically. Thanks to Mistral Large’s Retrieval-Augmented Generation (RAG) capabilities, the AI assistant harnesses the strengths of retrieval systems and generative models to extract relevant data and generate coherent, contextually appropriate responses. The function calling feature allows for specific tasks to be performed, such as generating graphics and other visual content based on the data retrieved. The BNP Paribas-Mistral AI partnership is just one example of this innovative approach in action. This strategic collaboration covers the full range of Mistral AI models and demonstrates the viability of European generative AI in the banking sector.

OUTSCALE and Mistral AI have since strengthened their partnership with the September 2025 launch of two major offerings hosted on OUTSCALE‘s sovereign and secure infrastructure. These offerings include “Le Chat,” a multilingual AI assistant for businesses, and “La Plate-forme 3DEXPERIENCE,” a comprehensive set of services and tools for developing and fine-tuning AI models, accessible via the OUTSCALE Marketplace. This offering is enhanced with special business overlays, including an advanced OCR (optical character recognition) feature that facilitates the automatic extraction of information from images, pdf files, and tables. These technologies are specially designed for financial institutions, and offer a Retrieval Augmented Generation (RAG) interface for accurate document searches and rapid data synthesis. The creation of specialized AI agents makes it possible to adapt and train models for specific business tasks, accelerating document processing and decision-making.

“By offering Mistral AI’s ‘Le Chat’ and ‘La Plate-forme’ on OUTSCALE SecNumCloud 3.2, we are providing a way for financial institutions to adopt artificial intelligence without compromising in terms of compliance and regulatory requirements. As part of a customized rollout tailored to each organization’s requirements, our customers benefit from a scalable offering, both in terms of models and features.” – Rui Jorge Lopes, EMEA Manager, OUTSCALE

OUTSCALE: A Technical Solution to Sovereignty Issues

OUTSCALE’s infrastructure meets specific requirements in terms of data security and sovereignty. It has received a SecNumCloud 3.2 certification and complies with strict European and French security standards. This certification guarantees data sovereignty in line with GDPR compliance and European AI regulations. OUTSCALE‘s technical specifications also comply with the sector’s regulatory requirements:

- No data transfers or tracking. LLMs are used without feeding training sets, thus protecting sensitive information;

- 100% private GPU infrastructure, high-performance computing dedicated to LLM workloads;

- Ready to deploy in 10 minutes via the OUTSCALE Marketplace with access to the complete catalog of Mistral models;

- Bias control, transparency, and customizable safeguards built into the AI layer.

With OUTSCALE, banks can roll out generative AI workloads on a sovereign and certified cloud, in line with the industry’s privacy and performance requirements.

Meeting the Challenges of Regulatory Compliance

The adoption of generative AI in banking comes with complex regulatory challenges that institutions must anticipate and master. The European AI Act designates credit scoring as “high risk” and imposes strict transparency rules for generative AI. This Europe-wide legislation, enforced by national authorities, will come into full force in August 2026 under the supervision of the ACPR in France. The issues surrounding AI explainability pose a major technical challenge. As Denis Beau, First Deputy Governor of Banque de France, pointed out in a speech delivered in February 2025: “Everyday users of AI systems must understand how these systems work and their limitations well enough to use them appropriately and avoid the twin pitfalls of systematic mistrust or blind trust in the machine.” Algorithmic fairness is another key issue. AI can amplify biases in data, which is particularly problematic in activities such as lending where customer segmentation is part of normal risk management practices. Cybersecurity is the third and final component of a responsible AI transformation—and arguably the most important!

OUTSCALE: A Technical Solution to Sovereignty Issues

In this context of innovation and regulation, Dassault Systèmes’s OUTSCALE solution is designedto meet the challenges of generative AI within the banking sector. By combining the power of Mistral AI with a solution that meets all sovereignty and security requirements, OUTSCALE allows financial institutions to implement generative AI solutions while adhering to strict regulatory constraints. This approach satisfies the operational needs of banking teams by reducing document processing time, automating complex analyses, generating customized reports, and improving the customer experience. This offering is part of a European approach to AI: powerful, ethical and sovereign.

Generative AI is now an operational reality that is changing the daily lives of professionals in the banking sector and reshaping the customer experience. The challenge facing every institution is to successfully integrate this technology while preserving the trust that remains the foundation of banking.

Did you find this article interesting? Learn how Dassault Systèmes is transforming financial services with its advanced digitalization solutions.