Nearly three-quarters of startups and SMBs in engineering say design and prototyping are their top innovation priorities—yet budget constraints, market uncertainty, and talent shortages threaten to slow their momentum.

These are not abstract trends. They come directly from over 100 professionals working in engineering, product development, and manufacturing roles across a wide range of industries. Startups and small and medium businesses (SMBs) are often at the heart of industry change. With lean teams and fewer layers of approval, they can respond quickly to opportunities, experiment with bold ideas, and find competitive openings that larger enterprises might miss. But speed alone doesn’t guarantee success.

To better understand how these innovators work, Engineering.com, sponsored by Dassault Systèmes, conducted a focused survey of engineering-driven organizations. The results reveal where smaller companies excel, where they struggle, and what technologies they are betting on for the future.

About The Innovation Survey

This study is grounded in the voices of 111 professionals shaping the future of engineering and manufacturing. The group included:

- 35% startups (≤$5M annual revenue, fewer than 100 employees, and ≤5 years old)

- 72% SMBs (<1,000 employees)

- Roles such as mechanical engineers, product designers, R&D specialists, and engineering managers

Most respondents were based in North America, with additional input from other global regions. This diversity ensures the findings reflect both regional realities and broader market trends.

Key Findings at a Glance

Finding #1: Design is king.

74% of startups and 73% of SMBs ranked design and prototyping as their top innovation priority.

Finding #2: Different innovation drivers, same goal.

SMBs and startups name customer feedback as their leading innovation driver (58% and 46%).

Startups lean also on emerging technologies (41%) to push their products forward.

Finding #3: Tools matter—but so does how they are used.

3D CAD/CAM (71%) is widely adopted, and cloud-based collaboration platforms (53%) are prevalent.

Simulation tools boost quality and reduce risk, yet over 25% of respondents report not using them at all.

Finding #4: Barriers remain stubbornly consistent.

Across company sizes, budget constraints lead, followed by market uncertainty and talent/skills gaps.

Finding #5: Emerging tech is high on the agenda.

AI, advanced robotics and 3D printing top the list of planned investments over the next two years.

69% of startups have AI/ML in their near-term plans.

Conclusion

If your team is balancing bold ideas against limited resources, you’re not alone. This report offers a clear benchmark of how innovators like you are approaching product development—and where they see the biggest opportunities for improvement.

📄 Download the full report to see the complete data and analysis: discover.3ds.com/startup-and-smb-survey

🌐 Explore how the 3DEXPERIENCE platform on the cloud can accelerate your next breakthrough product: www.3ds.com/cloud

Coming next: In our follow-up post, we’ll dig into the most surprising and thought-provoking survey findings—insights that could reshape the way your product development team tackles its next innovation challenge. Stay tuned!

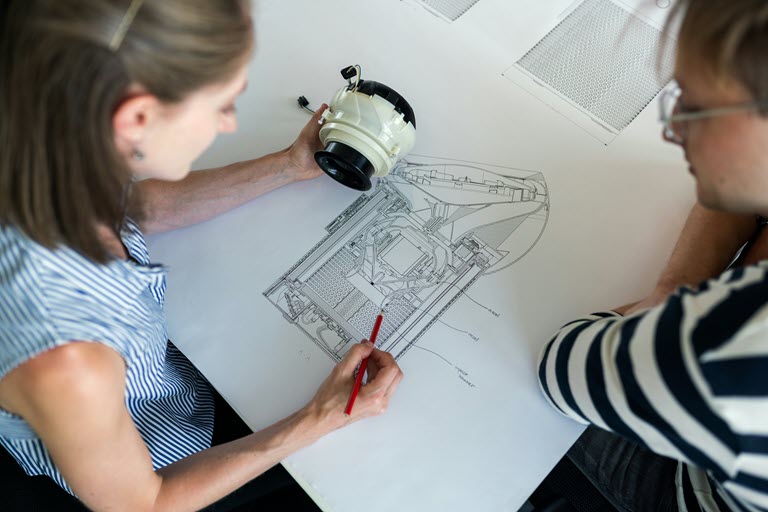

Photo attribution: ThisIsEngineering